Welcome to

On Feet Nation

Members

-

Kiran Aggarwal Online

-

Alma Online

-

Marion Online

-

Adele Online

-

geekstation Online

-

Agatha Online

Blog Posts

Top Content

The Best Guide To Who Has The Cheapest Car Insurance Quotes In Florida? (2022)

Firms are beginning to identify that age does not always comprise a greater threat and also they are slowly beginning to change. Healthcare Prices, According to the Republic Fund, Florida locals pay a lot extra for medical care than the average united state As a result of this and the truth that the state requires insurance provider to pay for clinical expenses incurred after a crash regardless of that was at mistake, the rates of insurance are a lot higher (laws).

Business understand that they will wind up paying far more per-accident and also they change their rates as necessary. If you are caught driving without insurance policy, the charges can be steep as well as you could also wind up losing your permit or your ability to get insurance in the future. If you are caught when without vehicle insurance in Florida, you will certainly need to pay a $150 reinstatement cost and also you might have your license and registration put on hold for as much as three years if you do not reveal evidence of insurance promptly. If you are driving without insurance and also finish up entering a mishap, not just can you potentially be held directly in charge of any type of damages, you will likewise need to finish an SR-22 certification. This certification might trigger you to pay much higher auto insurance coverage rates in.

the future and also make it hard to get any kind of insurance coverage in any way. If you are mosting likely to cancel your insurance policy, you have to surrender your permit plates and tags before you do so. Exactly How to Obtain Economical Auto Insurance Coverage Rates in Florida, Even though insurance prices in Florida are high, there are ways you can lower your private prices.

Insurer take where you live right into account but they likewise think about numerous other aspects that you have control over. Keep a Tidy Driving Record, The most effective thing to do to keep your insurance coverage costs reduced is to be a secure vehicle driver as well as keep a clean driving document. Greater than anything else, companies will certainly take a look at your driving background as well as make their determination for your rates. By driving thoroughly and also preventing problems, you can maintain your prices reduced. Depending upon the business, they will check out your record for the past 3 to five years. Some offenses, such as a DRUNK DRIVING, will certainly get on your document for a lot longer and will certainly have even more of an effect on your insurance prices. Buy a Safe Automobile, The type of automobile you drive will heavily affect how much you pay for insurance coverage.

The greater your credit report is, the lower your insurance costs are likely to be. You can increase your score and obtain great debt in lots of various ways. Points like paying costs on schedule, keeping your financial debt low, and also having a long credit rating can all have a positive effect on your credit rating. By integrating your automobile insurance plan with your house owner's or occupant's insurance coverage, you can pay less for every one of them. Depending upon your insurance coverage provider, you ought to be able to obtain all the insurance coverage choices you require in one place. Look around, Obtaining as lots of quotes as feasible for your auto insurance can help you get the most effective price. Inspect with your service provider or insurance representative to see if you are qualified for any one of these rate reductions. Drive Less, Among the finest ways to get a less expensive price on your insurance policy is to drive your car much less. Lots of business provide per-mile insurance strategies that will cover you like any type of various other plan however will depend on just how lots of miles you drive. Final Ideas, Even though Florida has several of the highest possible insurance policy prices in the nation, there are numerous methods you can conserve cash on your insurance coverage. By recognizing some of the aspects that determine your rate, you can get the feasible price. While you may not be able to manage where you live, you can deal with numerous various other points to obtain a better rate for your auto insurance in Florida. About 200,000 crashes are videotaped yearly in Florida. The terrifying truth is that Florida is among the most harmful states in the country to drive in. It is additionally a no-fault state which comes with specific needs for insured vehicle drivers that are different than other states. This can develop some confusion for Florida vehicle drivers when it involves assessing their cars and truck insurance coverage. car. Much of our clients have what would be thought about a "Complete Protection"vehicle insurance coverage plan and are stunned when it does not give adequate to cover the clinical expenses and/or the residential property damages costs resulting from their accident. The term"complete protection car insurance coverage" is utilized usually by insurance policy service providers in order to describe a policy that must secure drivers in the majority of kinds of incidents. What specifically does"full protection "indicate? Just how can this term be misinforming when choosing the best car coverage? The term"complete protection" for auto insurance policy does not have a typical interpretation. It is essential to personalize a car insurance plan to match your individual needs as opposed to acquire a one-size-fits-all plan. Just How Much Does Complete Protection Auto Insurance Policy Cost in Florida? Kinds of protection, limits, and deductibles impact your costs. It is very important to keep in mind this when contrasting auto insurance coverage rates. Those that pick to lug higher limitations of coverage than the state needs will most likely need to pay a higher premium than those with the state's minimum limitations. You pay even more if you are a young motorist or if you have a history of offenses as well as cases than if you were an older driver without tickets or mishaps. Just How Protection Minimums Are Impacted By Florida Being a No Fault State The no-fault system in Florida implies that your PIP insurance covers your injuries regardless of which chauffeur created the mishap. As a result of this protection, if you endure injuries in an automobile crash brought on by one more motorist, whose insurance coverage is either uninsured or insufficient to cover your clinical expenditures, you will be shielded. In case you are not exactly sure whether you have this sort of insurance coverage at the minute, call your insurance coverage supplier and also ensure it remains in location. Most of individuals do not know whether or not they have this type of insurance coverage. A Florida insurance holder need to officially turn down uninsured driver insurance coverage.

What Does Florida Bill Could Raise Auto-insurance Rates If Signed - Wfla Mean?

As an outcome, some insurance policy holders reject this sort of protection without completely recognizing what it is and what they stand to lose by not having this valuable protection. affordable car insurance.

Our clients' cases are maximized if we understand which evidence is most useful to insurance provider and which is not. As legal representatives, we know with exactly how to preserve evidence and fulfill target dates for resolving an instance. While their advertising might be concentrated on having your back in any kind of negative circumstance, the truth is that your insurance policy provider is a firm that needs to remain in service.

We strongly suggest not viewing the insurance adjuster appointed to assess your claim as your good friend. Anything you claim when speaking to an insurance adjuster can and also will be used versus you. Even if you beware when communicating with the insurance adjuster, insurer have committed groups (that include their very own lawyers) that are concentrated on doing whatever it requires to save the company cash.

Our team of attorneys has substantial experience taking on these insurer in court. This regrettably is commonly called for in order to receive the compensation one truly needs following a severe cars and truck crash in Florida. Request a Free Consultation With an Individual Injury Attorney at Herman & Wells Most of individuals do not think of amounted to vehicles and catastrophic injuries until it's far too late.

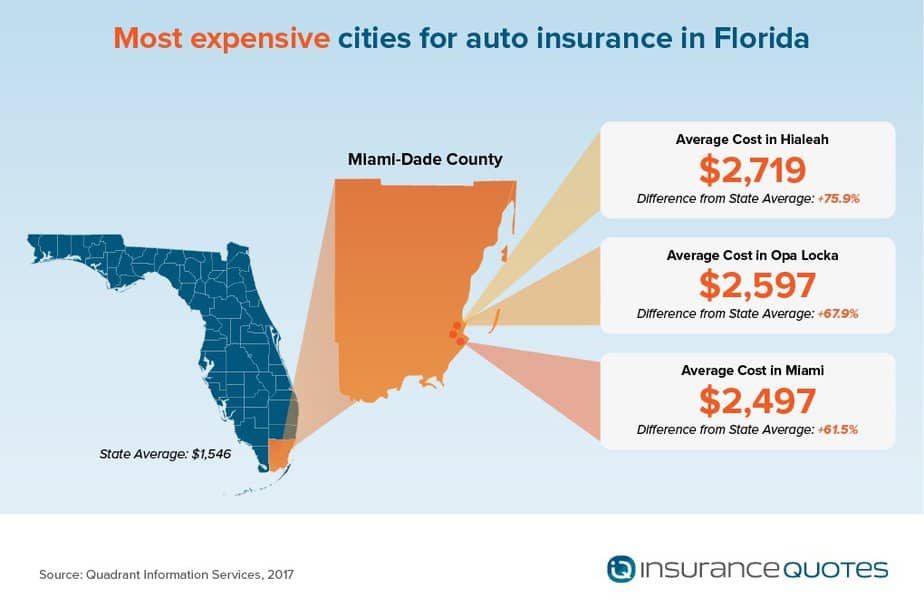

It's clear to Florida vehicle drivers that auto insurance coverage in the Sunshine State is expensive, yet a brand-new study locates that insurance coverage costs for Floridians can vary dramatically depending on the city or area they call house. cheap car insurance. If you need help searching for budget-friendly insurance rates in Florida, i, Q can aid you contrast multiple insurance prices estimate. cheapest.

Some Known Details About Florida Car Insurance Coverage

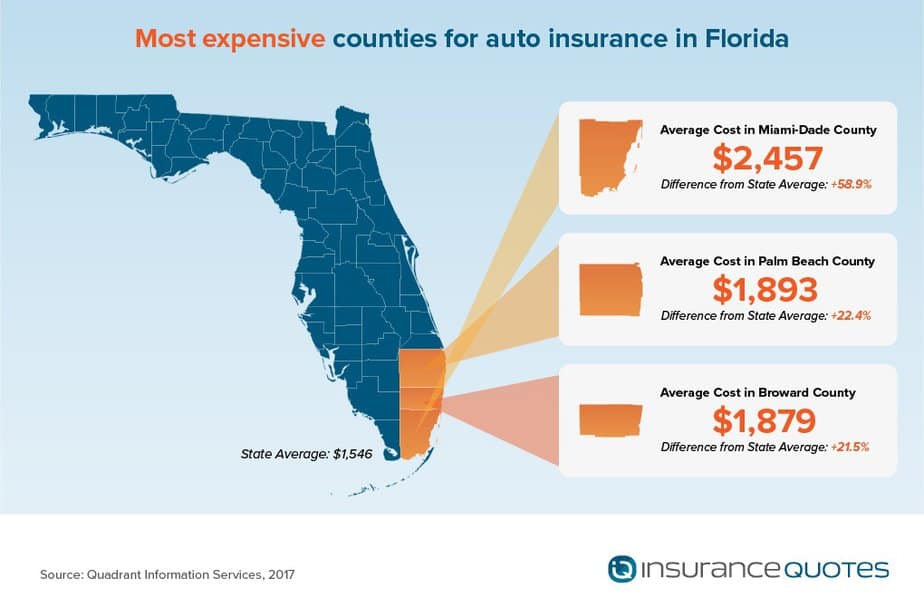

The rate of insurance can turn significantly from area to region. Take into consideration, as an example, that motorists in Miami-Dade Region pay, on average, $2,456 for auto insurance 59 percent greater than the statewide standard. Vehicle drivers in Alachua County pay 24 percent much less. Florida insurance coverage experts as well as experts state these distinctions may be startling to the typical chauffeur, but speed up to add that they logically

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation