Welcome to

On Feet Nation

Blog Posts

Aluminum sheet prices 4x8

Posted by xuanxuan geng on November 9, 2024 at 12:11am 0 Comments 0 Likes

Aluminum sheet prices 4x8 of HUAWEI aluminum is very reasonable and can save your purchase cost with the quality guaranteed. Aluminum sheet 4x8 produced by HUAWEI aluminum has high precision, the vertical and horizontal parallel error of plus or minus 2mm. According to the needs of different customers, 4x8 aluminum sheet can be placed in two directions on the plane, and the accuracy is very high. The vertical and horizontal parallelism error is plus or minus 2 mm, the vertical and horizontal…

Continuexathjrrc

Posted by Rebecca on November 9, 2024 at 12:08am 0 Comments 0 Likes

bxcegrpk

Posted by Thomas on November 9, 2024 at 12:08am 0 Comments 0 Likes

Top Content

Driving Without Insurance - Confused.com Fundamentals Explained

What are the consequences if you get pulled over without insurance? In many states, if you are pulled over for the very first time and you have no automobile insurance coverage, there will be a fine. In California, for example, you will pay near $500 for a first offense. In addition, other states, such as Florida, will suspend your chauffeur's license and registration and need significant fees to have them restored.

You would then be accountable for pulling charges and other costs included and might not have the ability to get your vehicle back till you have proof of auto insurance coverage. It's not likely to occur with a first offense, the majority of states also schedule the right to prison you for driving without auto insurance coverage.

Some Of What If I Don't Have Car Insurance In An Accident? - Tronfeld ...

There might be injuries and home damage as a result of the mishap, and you might be responsible for it all, particularly if the other motorist doesn't bring uninsured/underinsured driver protection. If you are at fault in the accident, the duty to pay these expenses rests on your shoulders. If you are unable to pay this, may you deal with the risk of personal bankruptcy or other financial distress.

How do you get vehicle insurance when you are uninsured? You may not be qualified for the lowest premium since driving without insurance coverage puts you in a higher-risk category.

Fascination About Driving Without Insurance: State-by-state Penalties For 2021

As a very first action, take a look at significant automobile insurers, such as Geico and Progressive, due to the fact that they offer very competitive rates and protection can be acquired online or through representatives. Inspect out local insurers that provide coverage in your state who may be more willing to overlook your faults and supply fairly priced protection.

A few states, such as California and New Jersey, provide low-priced vehicle insurance coverage choices for those who can not otherwise afford it. What are my state's minimum requirements for insurance?

More About What Happens If You Hit An Uninsured Motorist? - Freeway ...

Keep in mind, you can just recuperate UIM advantages if you purchased this kind of coverage prior to you were involved in your accident. If you do not have this additional insurance protection, you may have to demand compensation from another insurance company or interested party. Consider There Might Be More Than One Liable Party Accidents are rarely black and white.

If someone other than the uninsured driver shares any degree of responsibility, you can rest guaranteed that Mirman, Markovits & Landau, P.C. will work hard to hold them responsible. Relative Carelessness and Apportionment of Liability When somebody contributes to an accident, they're designated a few of the blame. The bigger their function in triggering the accident, the more blame they're assigned.

The Only Guide for What Happens If The At-fault Party Isn't Insured? - Langdon ...

Let's state you're struck by an uninsured driver at a crossway in Manhattan. They attempted to hit their brakes but weren't able to stop their vehicle before slamming into you.

The maker is assigned 20 percent of the blame for the crash. As a result, the maker can be accountable for approximately 20 percent of your accident-related damages. While this may be a portion of your expenses, it can make a huge difference when the person who is accountable for 80 percent of your injuries can't pay.

Not known Details About Auto Liability Insurance - New York Dmv

New York state law needs all vehicle drivers to acquire cars and truck insurance coverage due to the fact that the expenses of a mishap can be comprehensive. When a chauffeur doesn't acquire insurance coverage, it might be due to the fact that they can't afford it.

Just one state in the country Maine has less uninsured chauffeurs on the roadway than New York. It's more tough to state how lots of motorists are underinsured. In New York, a driver has to reveal proof of insurance coverage when registering a motor lorry.

The Basic Principles Of Mandatory Insurance - Faq - Adot

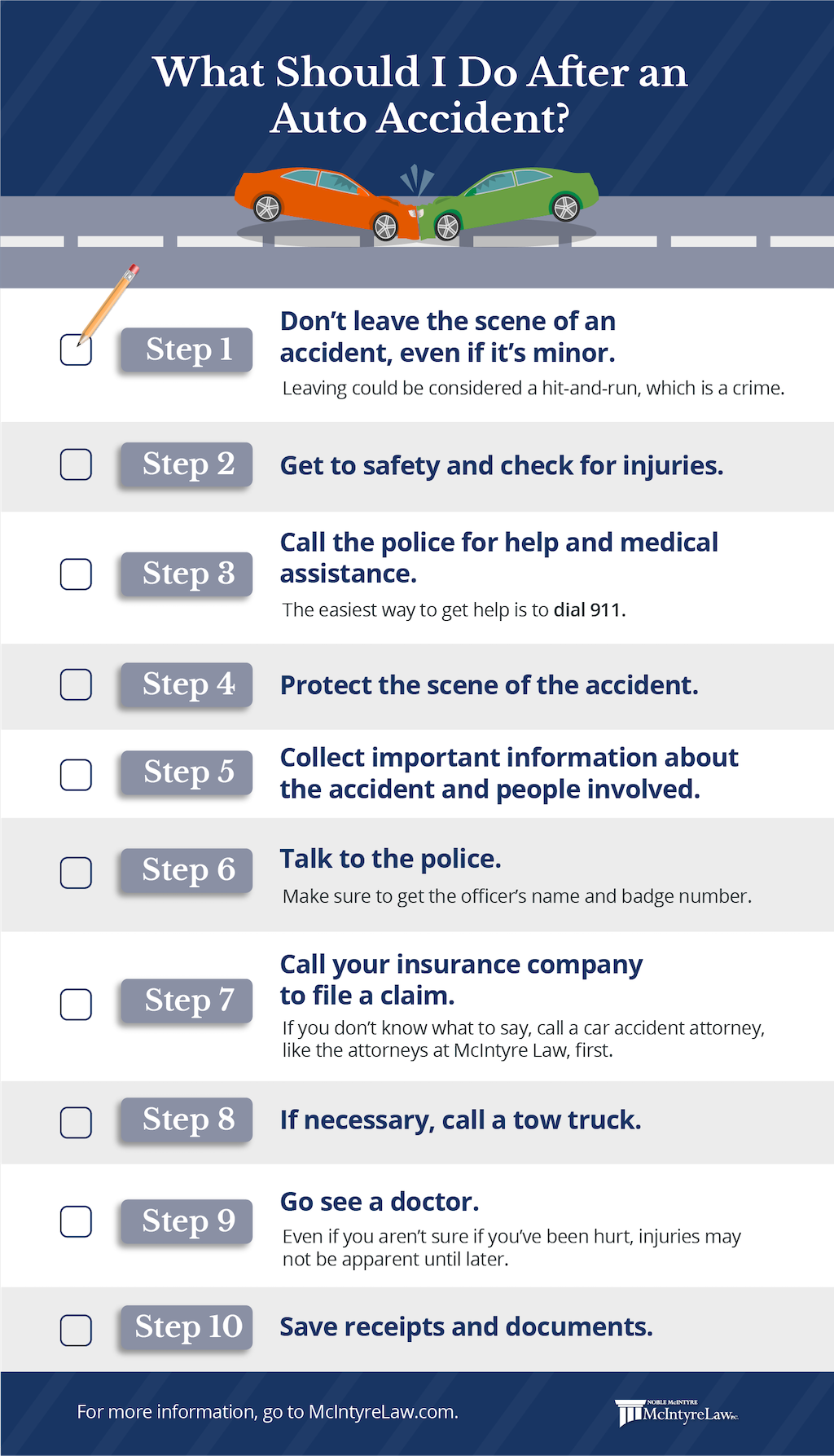

The state will not register a cars and truck if a chauffeur purchases a policy that doesn't satisfy the state minimum. In truth, you're most likely probably to encounter an uninsured motorist when a vehicle is not signed up with the state. What Should I Do After an Accident With an Uninsured Driver in NYC? Attempt not to panic.

: It's a criminal activity to leave the scene of a mishap in New york city if anyone was hurt or killed, or if there is considerable damage to home. Stay and exchange info with other motorists while you wait on the cops. If the uninsured chauffeur does not stay, try to keep in mind the make and model of their car, as well as the license plate.

Facts About What If The Other Driver Doesn't Have Insurance? - Citywide ... Uncovered

: Call the cops and report the mishap. If the other motorist is uninsured or underinsured, they'll most likely get a ticket when the cops show up on the scene. The officers will also complete a police report, which can be crucial if you need to submit an injury claim or suit in the future.

to set up a free consultation to discover the alternatives that may be offered to you. We're always available to take your call 24/7/365.

Get This Report on Penalties For Driving In New York Without Insurance

How Does Uninsured Motorist Coverage Work? Your finest bet is uninsured motorist (UIM) coverage, which is typically an add-on protection.

If you've got $75,000 in total liability coverage per accident, you can't generally bring more than $75,000 in uninsured vehicle driver coverage. Despite the reality that cars and truck insurance coverage is mandatory for authorized vehicles in operation in most states, the reality is that there are many motorists who drive without insurance coverage, and the best method to protect yourself is making sure you have plenty of UIM coverage.

Getting The Wisconsin Dmv Official Government Site - Minimum Insurance ... To Work

Similar to uninsured driver coverage, underinsured motorist protection will pay for damages sustained in an accident with a driver who has a car insurance coverage in place, however not enough protection to spend for your injuries coming from the mishap. Your underinsured driver protection (which is not required in many states, but is always readily available as optional coverage) kicks in and helps cover the difference between the other motorist's protection and the overall amount of your losses.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation