Welcome to

On Feet Nation

Members

-

Kiran Aggarwal Online

-

Alma Online

-

Marion Online

-

Adele Online

-

-

Blog Posts

Top Content

Why Did My Car Insurance Go Up for Dummies

And while they are less likely to consume than grownups, they have a higher incidence of being associated with a crash when they do. This is primarily due to inexperience. Teens are most likely to speed and tailgate, and less likely to wear security belts. They are likewise most likely to undervalue the gravity of the situation that they're in.

Automobile rental business usually will not enable a driver under the age of 21 to lease a car. And they will charge higher fees for rentals if you are in between the ages of 21 and 24. In the 20 to 24-year-old age bracket car insurance premiums began to decline, but only slowly.

Some Ideas on What Determines The Price Of An Auto Insurance Policy? - Iii You Need To Know

Vehicle insurance coverage premiums start to increase slowly from that point forward. It's not a lot that older motorists are more negligent, but rather that their driving is impacted by physical modifications connected to age. For instance, it prevails for older drivers to experience impaired vision, especially at night. They might likewise be handling different physical conditions, such as arthritis.

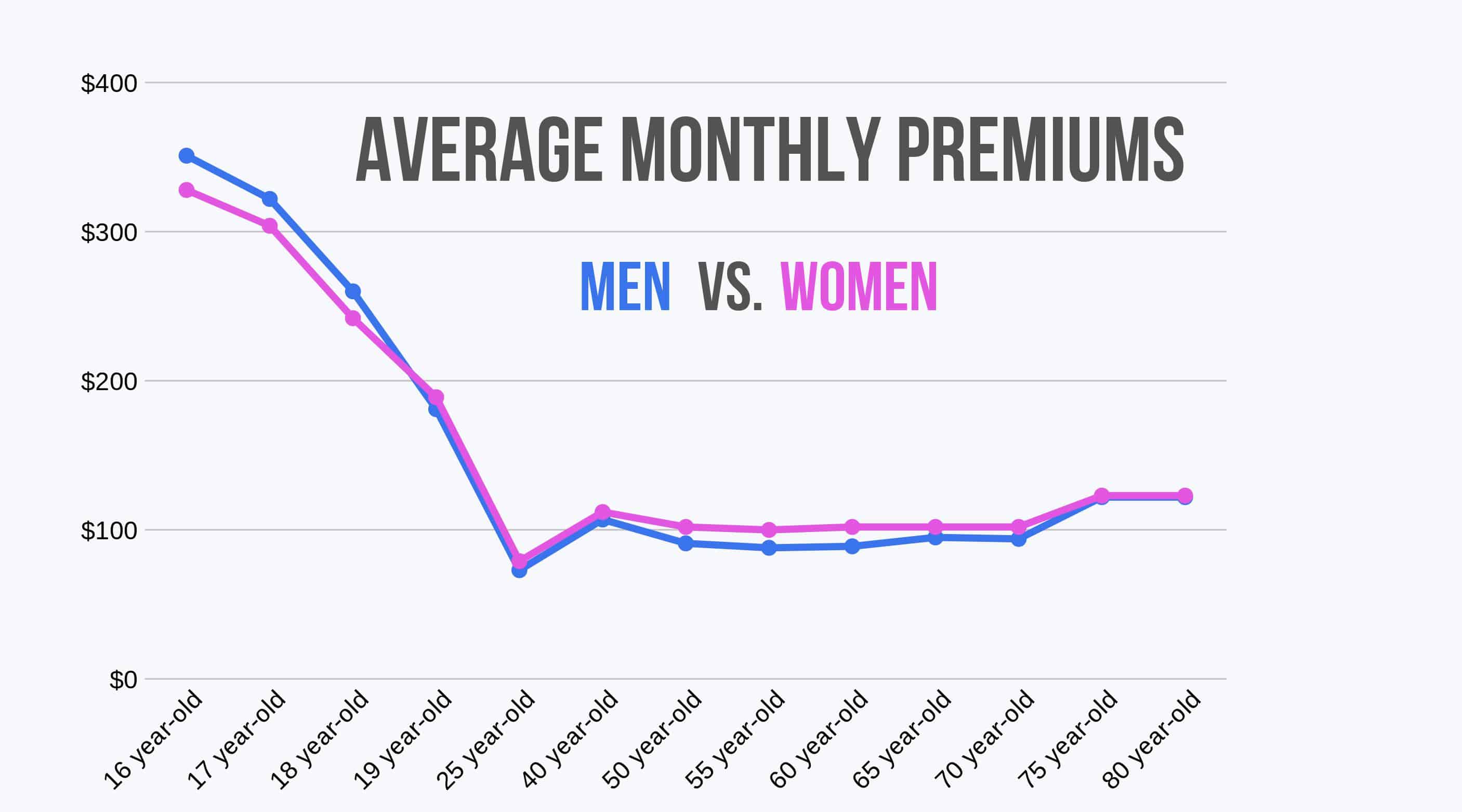

While there is no evidence that older motorists get associated with more mishaps, they are most likely to sustain serious injuries as an outcome of the mishaps that they're involved in. Gender likewise contributes Age isn't the only physical element that affects automobile insurance rates. Females normally pay less for automobile insurance coverage than men do.

What Does When Will My Car Insurance Go Down? Mean?

Males are likewise most likely to sustain traffic infractions, along with take part in driving while intoxicated. Apart from actual driving habits, males are more likely to own cars that are considered to be higher risklike cars, for instance. Regardless of the higher premiums that males usually pay, that outcome is not necessarily across-the-board.

Premium rates tend to be slightly more costly for female chauffeurs at ages 30 and 40. This may be due to the fact that of pregnancy and the likelihood of driving with little children and the interruption that they produce.

How Will Car Insurance Go Down At 25? - Thinkmoney can Save You Time, Stress, and Money.

Another important aspect is having several drivers on the same policy. Given that automobile insurance companies typically offer discounts for several motorists, a couple pays less than a bachelor. This can be particularly beneficial if one partner has an impaired driving record, and the other has a tidy record.

Of course, we all hope the premium has actually gone down. In reality, it's usually an increase. Great news though: Often you can get an insurance coverage decrease without having to in fact do anything to get much better rates.

The Best Strategy To Use For Adding A Teen To Your Auto Insurance Policy - Incharge Debt ...

You can check your Motor Car Record (MVR) by going to the MTO face to face or online here. When we state tickets, we imply convictions such as speeding tickets, seat belt, stop sign, DUI, and so on. If you battle the ticket in court and are successful, then those do not depend on your driving record.

Demerit points have absolutely no effect on your insurance coverage rates. Demerit points are only utilized to suspend or rescind chauffeur's licenses. Numerous minor tickets don't come with any demerit points, but the tickets will still affect your insurance rates.

The 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia Ideas

: 6 years For how long Do Non-Payment Cancellations Impact Rates? Cancellations for non-payment stay on your record for 3 years overall. Ensure you don't get cancelled by the insurance business since you can't pay. This has influence on your rates should you wish to get insurance coverage again.: 3 years At What Age Will My Insurance Rates Drop? This question gets asked a lot by younger motorists.

For boys, your rates likewise go down at 19, 21, and 23 years of age. When you strike retirement age, you can get approved for another discount. If you are over 65 OR are getting earnings under the Canada Pension, you can receive a discount rate of around 3%. It's very little of a conserving, however you may as well make the most of anything you can get.

Little Known Questions About 7 Factors That Raise And Lower Your Car Insurance Rates In Ontario.

As your automobile ages, the value normally depreciates. The less the vehicle is worth, the less it costs to fix or replace. Your automobile insurance rates should go down as your car gets older, all things being equal? However, not all elements are equivalent when identifying car insurance coverage rates.

Put the car in your garage, drive safe, and save cash on protection you might not need.: Not automatically Do Insurance Companies Lower Their Rates? Most insurance provider change their rates at least as soon as per year. Some companies alter their rates numerous times per year, or even monthly.

The Buzz on How Age And Gender Affect Car Insurance Rates - Forbes

Variables such as the number of claims, fraud, severe weather condition and the economy, to call a couple of, all consider. While your driving record could improve or you've simply turned 25, you might receive a renewal with a huge increase due to the fact that of flooding in another province or the economy not doing so well.

COVID is a fine example of what can happen when countless individuals stay at house and claims minimize. The insurance provider will start decreasing your rates on renewal.: Based on outside aspects Do I Qualify for VIP Discount? While there is no such thing called a VIP discount rate, numerous insurer have rates for "Preferred, Elite, or Valued" clients.

The Definitive Guide to Will Car Insurance Go Down At Age 25? - Car.co.uk Faqs

Cost savings of 10-20% are not unusual simply for being an accountable customer for a long duration of time. The finest part is: Absolutely nothing requires to be done to certify. The discount rate just pops up on your renewal.: For Preferred, Elite or Valued customers There are a great deal of aspects that can make your insurance coverage rates go up or decrease and not all of them are within your control.

Offer us a call or start a quote now: Thanks for reading our post on lowering cars and truck insurance coverage. Still looking for more information? Inspect out other insurance coverage items that we use:.

Not known Facts About Teen Drivers - Nc Doi

Having a teenager chauffeur can get expensive, rapidly. Perhaps one of those young motorists is your teen! Moms and dads and guardians require to put in the time to talk with teen drivers about the seriousness of driving safely. Teens must comprehend that driving is a benefit and if treated gently it can result in increased premiums and expensive repair costs, and at worst reckless habits behind the wheel could result in their death or the deaths of others.

They added a 16-year old teenager to the policy. This is what they saw happen to the rates: The average home's car insurance coverage expense increased 152%.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation