Welcome to

On Feet Nation

Blog Posts

Aluminum sheet prices 4x8

Posted by xuanxuan geng on November 9, 2024 at 12:11am 0 Comments 0 Likes

Aluminum sheet prices 4x8 of HUAWEI aluminum is very reasonable and can save your purchase cost with the quality guaranteed. Aluminum sheet 4x8 produced by HUAWEI aluminum has high precision, the vertical and horizontal parallel error of plus or minus 2mm. According to the needs of different customers, 4x8 aluminum sheet can be placed in two directions on the plane, and the accuracy is very high. The vertical and horizontal parallelism error is plus or minus 2 mm, the vertical and horizontal…

Continuexathjrrc

Posted by Rebecca on November 9, 2024 at 12:08am 0 Comments 0 Likes

Top Content

The 3-Minute Rule for Nine Ways To Reduce Your Teen Driver Auto Insurance Costs

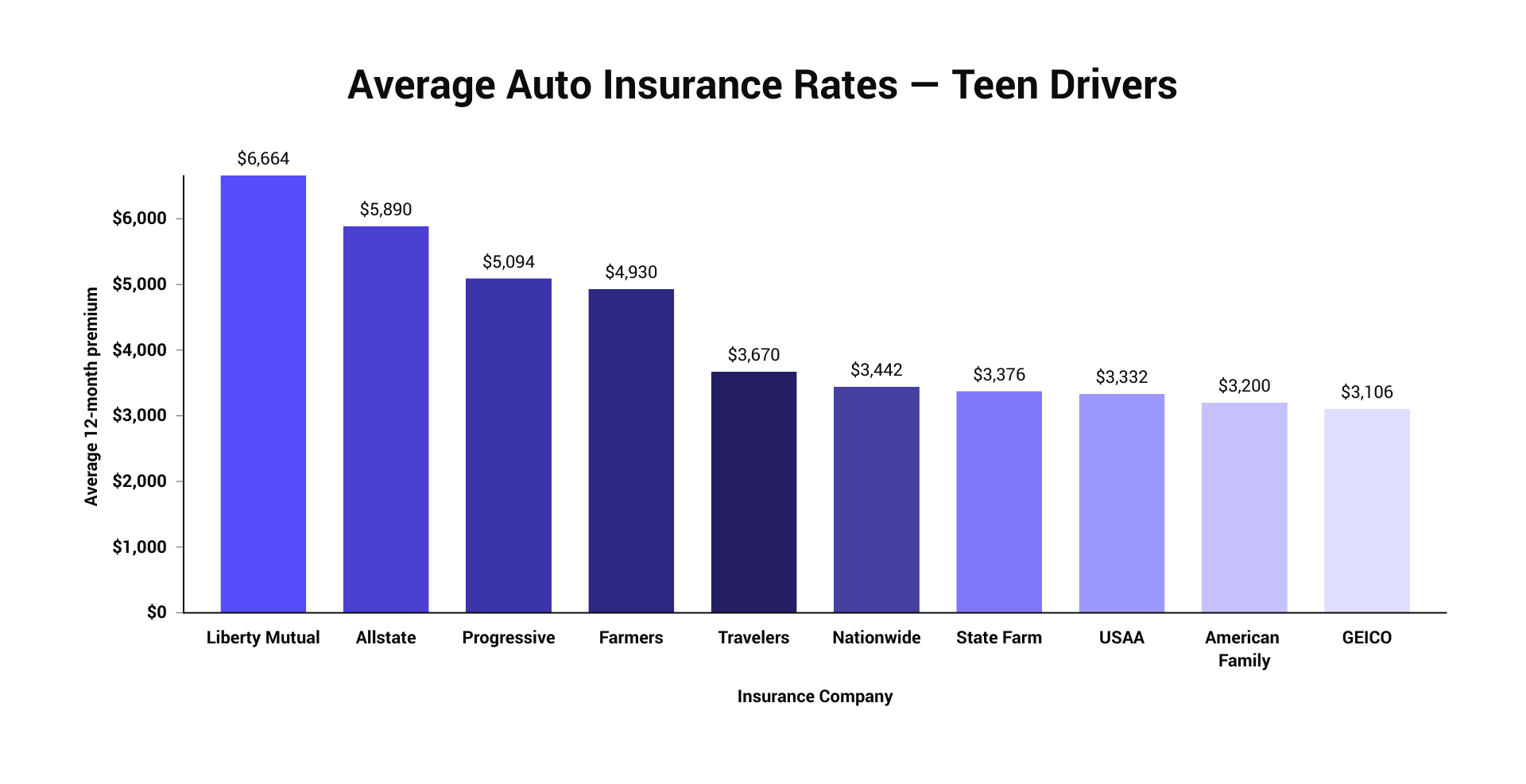

Here were 3 most inexpensive providers of automobile insurance coverage for teen motorists in New York.$3,200 State Farm$3,500 Geico, Final Words, Going through the above samples, there isn't one clear business that can be thought about best cars and truck insurance for teenager motorists in every state.

All three of those insurers ranked in the leading three in 3 of the 5 states revealed above. At the end of the day, unless you're moving to a different state quickly, your only concern requires to be: what's the best and lowest-cost vehicle insurance supplier in state. And to discover that out, you'll desire to get several quotes from insurers in your state or use an online contrast shopping tool like Policygenius.

If there's a brand-new teen driver in your household, you require to guarantee them. Adding a teen motorist to your policy can be costly, so check with your representative or insurance coverage business. They'll assist you find discount rates and other methods to conserve cash. Here's what you need to understand.

Discount rates aren't the only way to save on your teenager's car insurance coverage. Buy an older cars and truck The expense of a car assists determine the expense of your insurance coverage, so get your teen an older, less costly automobile.

Not known Details About Best Auto Insurance For Teens

This blog is your comprehensive guide, make sure to check out till the end and bookmark it to describe later on likewise. Our goal with this blog is to provide you with all the information you require to understand about buying car insurance coverage for a teenage motorist. You will get the information of all the very best business as well as the methods you can attempt to save more cash.

Why teen motorists get higher insurance coverage rates than any other motorist? The first concern that pops up in our head is; why teenage motorists get higher insurance coverage rates? As per the insurance coverage business around the nation; teen drivers are much risky as compared to other experienced drivers.

And this is the reason they charge higher from the teen chauffeurs. Most affordable car insurer for parents with a teen chauffeur The major concern of every parent who is searching for an insurance coverage policy for its teen chauffeur is to discover low-cost vehicle insurance for teenagers. The first thing all of us do when it pertains to cars and truck insurance is to search for "the least expensive automobile insurance coverage company for teenager chauffeurs".

But today, there are a lot of sites that are providing the rates from different cars and truck insurance provider in one location. Rather of relying on the details from others' check various business and compare the rates yourself. According to our analysis; GEICO has the least expensive car insurance rates for teen drivers.

How To Save Money On Teen Car Insurance - Dave Ramsey for Dummies

We also have USAA as the most inexpensive vehicle insurance coverage company, however it is just for current and previous military members. Let's have an appearance on top vehicle insurer for teen drivers around the country: GEICO GEICO is leading the race for the most budget-friendly vehicle insurance coverage in the country.

The motorists who have completed motorist training programs get discounted rates. The typical vehicle insurance coverage rate for complete coverage by GEICO is $4211 for a 16 years old chauffeur.

Nationwide Nationwide is popular not for its cheaper automobile insurance for newbie drivers however the features of the policies. The business has some specific features to support teenager and young drivers. Students who have approximately grade B or greater can get a great trainee discount. Plus the business supplies accident forgiveness for the first at-fault motorists.

The best part of Nationwide's policy features is the insurance measure for usage-based insurance. This for the motorists who have safe driving practices, they can conserve good cash. The typical cars and truck insurance coverage rate for complete coverage by Nationwide is $5421 for a 16 years of ages motorist. While for a 19 years old motorist the typical full coverage rate is $3462.

Some Of Teen Safe Driving Program & Discount - American Family ...

But the only problem is the. Just like Nationwide; USAA likewise has a Safe, Pilot program that provides custom rates for chauffeurs with safe practices. The business uses telematics to tape-record the driving habits and then create customized pricing for the driver's policy. Plus the company offers a discount rate for teen chauffeurs who have finished the motorist training program.

Additionally, they offer an extra good trainee discount rate for a typical grade point of B or higher. By integrating all these kinds of discounts the teenager drivers can get lower insurance rates as compared to the other companies. The average car insurance coverage for 16-year-old chauffeurs for full protection by Nationwide is $5725.

Discover most inexpensive automobile insurer for your teens. Typical expense of automobile insurance for teenagers by coverage level Wondering what coverage level will be more appropriate for the teenager motorist? Confused if you ought to choose complete protection insurance coverage of the state's minimum insurance protection for your teen? We can comprehend your situation, every company has different suggestions for the parents and this leads to more confusion.

When you need full coverage insurance coverage for teen drivers Let's say you have a Mercedes Benz and you desire to add your teen to your policy. The best protection for you will be complete protection (accident and thorough coverage). The major factor behind this is; high-end or cars have pricey parts and the repair expenses for these lorries can be a bit expensive.

Little Known Facts About Cheapest Car To Insure For Teenager: Everything You Need To ....

As a result; if the cars and truck gets amounted to in an accident then changing the cars and truck can dig a hole in your pocket. With full coverage insurance, you don't have to stress about the repair work or replacement of the vehicle. The cost of full coverage can be higher however it will be at least worth it.

This is since the expense of the premium is going to be more than the worth of the automobile. Expense of adding a teen to your automobile insurance coverage Baffled if you should add your teen to your policy or you should purchase a different policy for him or her? We have an easy solution for you, you can merely ask your company for the 3 various types of quotations.

, adding a teen driver to your policy is half as pricey as buying a separate policy for the exact same teenager driver. Adding your teen motorist to your policy is a more affordable alternative for you.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation