Welcome to

On Feet Nation

Members

Blog Posts

drzjwosd

Posted by Tim on November 12, 2024 at 7:39pm 0 Comments 0 Likes

oujgfqda

Posted by Carlos on November 12, 2024 at 7:39pm 0 Comments 0 Likes

Top Content

The smart Trick of Cheapest Car Insurance In California For 2021 - Wallethub That Nobody is Talking About

While California's minimum liability limitations are sufficient to fulfill the legal requirement for motor lorry operation, they may not suffice to cover all the costs for repair work and medical care after a serious accident. Raising your liability limits will keep you from having to pay for anything out of pocket.

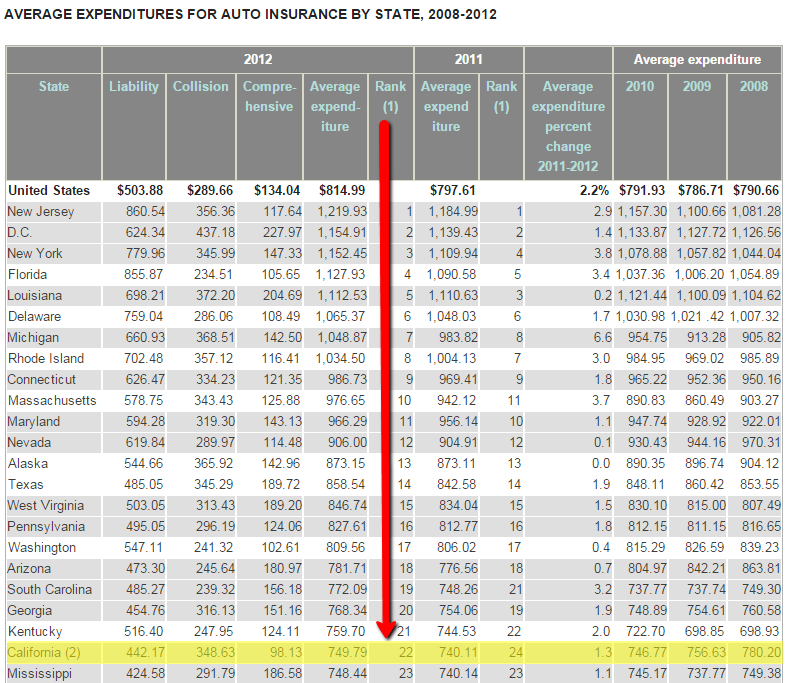

If you desire your expenses covered, consider acquiring complete coverage.What Is the Typical Expense of Car Insurance Coverage in California?, California drivers pay, on average, $1713 a year for cars and truck insurance.

Car Insurance Rates By State 2021: Most And Least Expensive Fundamentals Explained

What Are the Leading Insurance Provider in California? As Quote, Wizard explain, price isn't the only thing you should think about when choosing a vehicle insurance supplier. They advise that you buy a policy from a business with high client satisfaction rankings. That method, you will not have to deal with concerns like slow claims processing.

Market information shows that California has more hybrid and electrical cars on its highways than any other state. When you buy one of these cars, your insurance company will reward you with a discount.

The Greatest Guide To Surprisingly High Car Insurance In Orange County, Ca

Motorists in the Golden State pay an average of $2,065 annually, or about $172 monthly, for full protection vehicle insurance coverage, according to Bankrate's 2021 survey of quoted yearly premiums. To identify the average expense of vehicle insurance in California, our insurance coverage editorial team examined typical rates offered by Quadrant Info Provider for metro locations throughout the state.

Drivers in Los Angeles pay the most by far for vehicle insurance coverage, according to our research, with a typical rate for full coverage insurance of $2,838 per year, 37% above the state average. California moms and dads adding a 16-year-old motorist to their full coverage car insurance coverage policy can anticipate a typical annual increase of $3,744 per year.

Getting My How Much Does Car Insurance Cost In California? (2020 ... To Work

The typical cost for state minimum coverage is $733 per year. While the typical automobile insurance coverage rates in California might help you determine if you are overpaying for protection, bear in mind that your premium will differ based on nearly a dozen private ranking elements like the kind of automobile you drive, your automobile record, declares history and how lots of miles you drive each year.

California vehicle insurance coverage rates Typical annual minimum coverage premium Typical annual complete protection premium $733 $2,065 California automobile insurance coverage rates by city, Vehicle insurance coverage rates in California differ by city. Motorists in largely inhabited locations tend to have higher rates. Having more lorries on the roadway might imply a greater opportunity of an accident.

The 9-Minute Rule for Cheapest And Best California Car Insurance Companies (2021)

Utilize this chart as a guide to assist determine your total expenditures so that you can decide what insurance coverage rates suit your spending plan. California automobile insurance coverage rates by age, A chauffeur's age frequently contributes to the expense of yearly premiums, as it can show how statistically dangerous a chauffeur is.

California automobile insurance rates by credit history, In lots of states, your credit-based insurance score will affect just how much you spend for car insurance coverage. This is due to the fact that drivers with low credit scores statistically tend to file more claims than motorists with greater credit ratings, according to the Insurance coverage Details Institute (Triple-I).

The Of 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

Regularly asked concerns, How much is vehicle insurance in California per month? Complete coverage car insurance costs an average of $172 per month and minimum protection costs $49 per month, on average, in California.

Nevertheless, the Triple-I advises you think about purchasing coverage levels above the state minimums for fuller financial defense. It is necessary to keep in mind that the state's minimum coverage does not include any coverage for your automobile if you are at fault in an accident. If you have a leased or funded car, you will likely require to carry full protection, which includes detailed and collision.

Getting The Healthcare.gov: Get 2022 Health Coverage. Health Insurance ... To Work

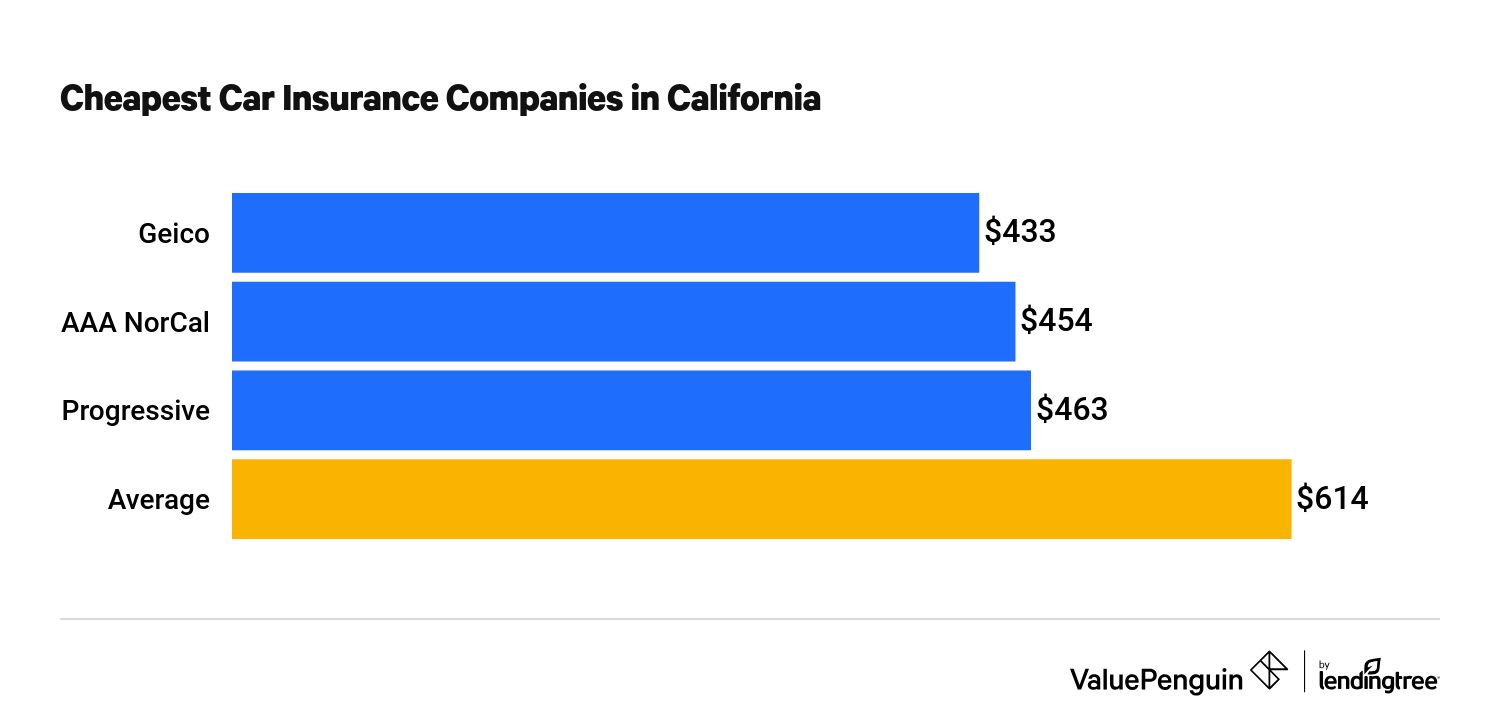

What is the best cars and truck insurance provider in California? Based upon our research, Geico, Progressive, State Farm and Wawanesa are among the best cars and truck insurance provider in California. However, the very best business for your requirements will depend upon what you desire and need from a vehicle insurance company. Understanding your choices and getting quotes from a number of various carriers could help you discover the right fit for your scenarios.

These are sample rates and should just be used for relative functions. Rates were computed by assessing our base profile with the ages 18-60 (base: 40 years) applied. Depending upon age, drivers may be a tenant or homeowner. For teenagers, rates were determined by adding a 16- or 17-year-old teenager to a 40-year-old married couple's policy.

How Much Does Car Insurance Cost By State? - Progressive Can Be Fun For Everyone

Rates were calculated by evaluating our base profile with the following occurrences applied: clean record (base), at-fault mishap, single speeding ticket, single DUI conviction and lapse in coverage.

It does not cover any of your injuries or damage to the vehicle if you are accountable for an accident. Based upon's rate analysis, non-owner automobile insurance plan costs $474 a year on average. A non-owner cars and truck insurance plan is for drivers who do not own a vehicle and are not routine motorists.

Our Cheapest Car Insurance In California Ideas

It spends for injuries and damages you cause in a mishap when you're driving a vehicle that another person owns. Non-owners cars and truck insurance coverage normally enters into play as a secondary coverage if the cars and truck owner's insurance falls brief in spending for the repair and medical bills. That suggests the insurance plan on the cars and truck you're obtaining will be utilized initially, and after that your non-owners insurance policy begins if you have higher liability limits than the car owner.

You borrow the cars and truck and trigger a mishap with $30,000 in damages, leaving $10,000 to be paid by you (or your friend). Nevertheless, or cover your injuries if you're at fault for an accident. Non-owners vehicle insurance coverage is a good suitable for you if you often rent automobiles or drive another person's automobile, or are attempting to keep constant protection during the time you do not own a vehicle.

Everything about How Much Does Car Insurance Cost? - Experian

Can you get car insurance without a cars and truck? Guidelines vary, but normally an insurer will require that: You have a legitimate driver's license.

With a non-owner insurance policy, you can acquire different liability limits. If your state has demanded that you file an SR-22 or FR-44 financial responsibility form, the state might determine what liability coverage amount you need to obtain. In certain states, non-owner automobile insurance can provide medical or uninsured driver protection.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation