Welcome to

On Feet Nation

Members

-

smithmorgan Online

-

Latest Market Trends Online

-

Thomas Shaw Online

-

Tom Dempsey Online

-

Felix Online

-

Linda Online

-

Cecile Online

-

DevinMarco Online

-

Phillip Online

Blog Posts

Best Reloading supplies for sale

Posted by smithmorgan on July 17, 2024 at 10:32am 0 Comments 0 Likes

Top Content

The Pros & Cons Of Home Loan

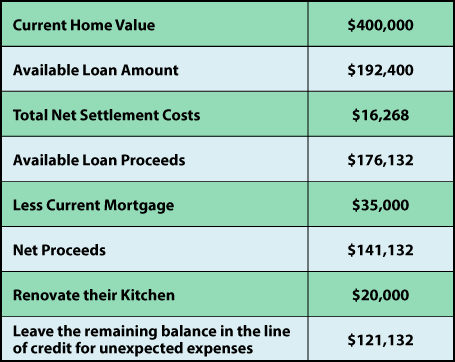

While the product has actually been very carefully inspected, we can not and also do not guarantee that the info provided is proper, accurate or current. Please speak to your Rothenberg Wide range Management expert for advice based on your distinct situations. Rothenberg Capital Administration is a member of IIROC and the Canadian Investor Defense Fund. If a reverse mortgage has dramatically lowered the equity of your house, there may be little financing delegated cover long-lasting care later in life. You generally have up to a year after leaving to either sell or develop the repayment, Pfau claims. The group of non-borrowing spouse, developed in 2015, means the staying spouse can remain in your house.

Not a surprise that there are a fair quantity of situations where it doesn't work out well without taking advantage of extra sources like residence equity. On Monday, we went over the nuts and also bolts of reverse mortgages. On Wednesday, Josh Guts went mentor financial https://sandus7beu.doodlekit.com/blog/entry/19740537/contrast-todays-existing-home-loan-rate-of-interest group into more detail with some of the creative usages for a reverse home loan. Today's blog post is going to be extra essential about them.

Chris- I would certainly suggest you have not successfully marketed your home with a reverse home mortgage. You can sell the home, refinance the home, you can alter directions anytime. There are no manacles with the HECM, it just offers you extra alternatives and also flexibility if the conditions of your retired life require them. For any individual still carrying a balance, that possibly means replacing an economical home mortgage with something a lot more pricey. The validation for greater rates as well as charges on 2nd as well as 3rd mortgage has actually historically been the higher danger from the main lien owner seizing after default. It doesn't make any feeling for the HECM loan provider to obtain all the additional benefits that include added danger when there is properly no danger in any way to making the financing.

- Unlike a Home Equity Line of Credit or a bank card, the funding will not remain open with a zero balance.

- Then you can choose if those problems are a large offer to you or not.

- When considering whether a reverse mortgage is appropriate for you, it is very important to discuss with a housing therapist whether the net financing proceeds will certainly be enough to enable you to stay in your home.

- You may be able to alter your repayment option for a tiny fee.

This is why there are hardly ever CHIP Reverse Mortgage problems for beneficiaries; after your house is marketed as well as the mortgage repaid, there is generally a large amount of money left over. One more 90-day expansion can be requested, once again with HUD's approval. If your accumulated passion and principal get to the value of your residence, you will not get kicked out due to a forced sale, nor have debt continue accumulating. The unfavorable equity securities passed in 2012 prohibit both of those situations.

You Could Lose The Residence To Repossession Before You Work Out One More Alternative

For instance, expect your home is presently worth $500,000 as well as you market a 20% share of the future value. Relying on your age, the supplier may use you $37,000 to $78,000 to get that share today. When you market your home, the supplier receives their share of the profits. State in wyndham certified exit reviews two decades time you offer your residence for $800,000. The provider obtains 20% of the list price ($ 160,000), minus any discount. If you got a reverse home loan before this date, examine your contract.

Additionally, considering that the money from a reverse home loan-- whether offered in a lump sum or month-to-month-- is an additional car loan, it is not taxed. ( You are postponing tax on gains that will not need to be paid until your house is offered.) "Since it's not earnings, it does not impact federal government entitlements, such as your Aging Safety," claims Ranson. The primary risk is that your lending principal increases as the interest payments are contributed to it, and rates of interest for reverse home mortgages do not come low-cost. At the time of creating, Home Resources had reverse home mortgages with a variable rate of 5.15% and a comparison rate of 5.21%. An additional aspect of this that I do not like is that it is established so the loan provider can't shed.

If you did take all the funds at closing, there really is no drawback to taking the funds currently. We do not offer House Equity Lines of Debt, strictly reverse home mortgages. Michael G. Branson Chief Executive Officer, All Reverse Home Loan, Inc. as well as moderator of ARLO â„¢ has 40 years of experience in the home loan financial sector.

Is The Government Associated With My Reverse Home Loan In Any Way?

HECMs generally offer you larger finance developments at a reduced complete price than proprietary financings do. In the HECM program, a borrower normally can live in a retirement home or other medical center for up to 12 consecutive months prior to the funding must be paid back. Taxes and also insurance coverage still have to be paid on the financing, and your home must be maintained. An economic evaluation of your desire and capacity to pay real estate tax as well as property owner's insurance policy. Residence Equity Conversion Mortgages are federally-insured reverse home loans as well as are backed by the U.

House Equity Financing Or Residence Equity Credit Line

The financial institution does not pay any rate of interest to the customer on any lending. I would certainly reach to say that if you select to do this, pay back nearly the entire amount owed however leave a really little equilibrium of simply a pair hundred dollars on the car loan unpaid. For any person thinking about a reverse home loan, it's a great concept to speak with a relied on advisor. A reverse home loan can be a prudent economic move, yet the drawbacks must be considered. For a private or a couple that needs to make residence adjustments for aging in place, as an instance, a reverse home mortgage can aid pay for renovations.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation