Welcome to

On Feet Nation

Members

Blog Posts

Top Content

Some Known Incorrect Statements About 10 Top Car Insurance Companies For Young Adults In 2021

Nevertheless, there are methods to keep young chauffeur insurance costs lower, such as including them to an existing policy, seeking out discount rates they receive and teaching them safe driving routines that will eventually cause cost savings. Cars and truck insurance coverage policies for young chauffeurs No matter what state you reside in, having young motorist insurance coverage is a must.

A lot of insurer have unique vehicle insurance for young motorists. It is very important to discover what the policies entail, including coverage limitations. Some moms and dads add extra coverage when they seek car insurance for teens as a preventative measure. When should I consider buying vehicle insurance coverage for my teenager? Purchasing vehicle insurance coverage for teens usually happens after they pass a driving test and get their licenses.

Getting The Finding The Cheapest Car Insurance For Teen Drivers To Work

Most automobile policies will cover teenagers with a student's permit that are driving the vehicle of an adult in the exact same home, however it's never ever a bad idea to verify coverage with your vehicle insurance coverage company. The majority of insurance coverage agencies will require licensed motorists-- even teenagers-- residing in the exact same home to be covered.

The, so it's always a good concept to speak with your representative about young motorist insurance as your kid approaches driving age. Teenager chauffeur insurance coverage companies Almost all insurance provider can finance a vehicle insurance coverage policy for teenagers even though numerous new motorists end up on their parent's policy as quickly as they get their driver's license.

Facts About How To Get Cheap Car Insurance For Young Drivers Uncovered

When you've narrowed down your choices, it's time to consider the elements that go into making a decision on what makes up the finest young motorist insurance coverage for you. Elements to consider when choosing an insurance coverage company - this is most likely the single most important aspect that teen motorists or their moms and dads think about, and for good reason.

For this reason, it's suggested to search for the very best cost, however do not rely on this factor alone. another essential aspect when considering a young driver insurance coverage is the quantity of protection offered. There is no one-size-fits-all policy; the elements that affect the choice of how much protection ought to be purchased differ from person to person.

Excitement About At What Age Do Car Insurance Rates Go Down? - Money ...

For younger chauffeurs, it is a good idea to have a higher level of protection, even if they drive an automobile that has actually currently been paid for in complete. on automobile insurance coverage for teenagers as that often lowers the month-to-month rate. not all vehicle insurance coverage business are produced equivalent. Some are well promoted for their attention to detail and exceptional customer support skills, specifically when dealing with car insurance coverage for young motorists.

When shopping for young driver insurance coverage, ask your agent about any certifying discount rates that might be readily available. The cost of guaranteeing young chauffeurs There are numerous considerations that go into the cost of guaranteeing young drivers.

Young Driver Car Insurance - Consumer Coverage Can Be Fun For Everyone

Usually, a longer driving history and clean record will lower rates. Many young drivers run with a license to drive personal automobiles, but motorists with a license to run larger automobiles such as busses and trucks with heavy towing abilities may pay higher premiums for insurance coverage as their cars and towed items may cost more to cover.

- Parents who opt to include their young chauffeurs onto their existing policy will see a boost in their general insurance coverage premium. It's much easier for new, unskilled chauffeurs to become insured this way. The young driver insurance coverage cost will not increase as much if the kid is driving mother or daddy's car.

Some Known Incorrect Statements About Car Insurance For Teenage Drivers - Edmunds

Opening a brand-new automobile insurance plan for teens isn't frequently suggested because of the high expense. Insurer think about these young chauffeurs a higher danger and as such, it's not unusual for an auto insurance plan for teenagers to cost upwards of a thousand dollars annually. Numerous teenagers can't afford these rates, even if they are working complete time.

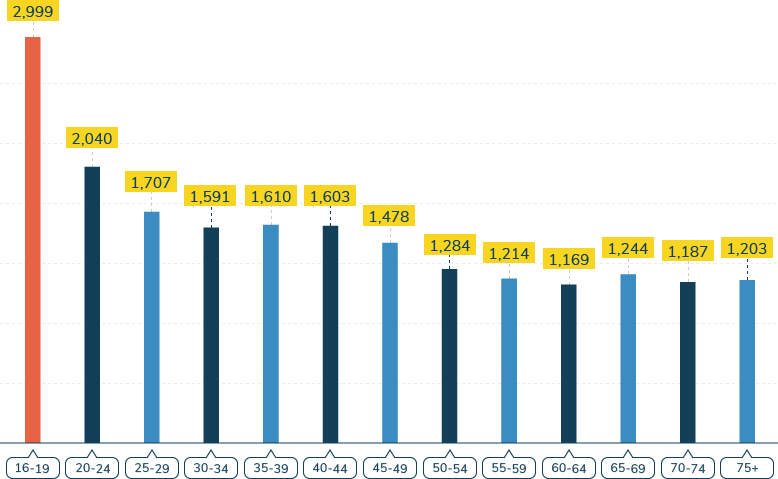

Conserving on teen auto insurance As with any young driver insurance coverage policy,. These discount rates are generally used to young motorists in between the ages of 16 and 24, though some insurance companies might have other varieties.

Not known Factual Statements About How To Add A Teen Driver To Your Car Insurance - Reviews.com

The quantity or portion discounted on vehicle insurance coverage for young motorists varies per agency, but it's worth making a questions. - loyalty discount rates come as teenagers and young chauffeurs preserve their policies with a particular company or representative. The longer they keep a policy with the business and keep their account in great standing, normally the better the discount rate.

Even teenagers can qualify for safe chauffeur discount rates on their insurance policy if they keep a remarkable record. You just install it in the vehicle and the tracker monitors the driver's routines.

See This Report about When Do Car Insurance Rates Go Down?

Does Your Teenager Need Insurance Coverage to Drive Your Automobile? Once a teenager passes a driver's test and receives a license, insurance is generally obligatory for a kid who drives your cars and trucks.

In many cases, families include teen motorists to the parents' policy. Some states enable a certified teenager to be omitted from the parental policy, however the majority of don't. Even if getting a different policy for the teen is possible, it is probably not useful because most states prohibit teens under 18 from having a title to a cars and truck in their own name.

Everything about How To Insure Teen Driver

Insurance coverage is a contract and a small isn't old adequate to sign one. Expense of Adding a Teenager to Your Insurance Coverage, Including a teenager to your auto insurance policy is extremely expensive. Your annual premium can quickly double when a newly certified 16-year-old signs up with the policy, though the expense differs by state and locations within states.

It may be appealing to purchase a policy that covers less, it increases your threat if you are in a major crash. Most state's have a bare bones requirement and insurance providers will write policies for smaller sized amounts of coverage. If you own an older cars and truck that has lost much of its value through devaluation, you might consider dropping detailed and crash coverage and taking the danger of fixing damage on yourself.

Some Of 5 Ways To Save On Auto Insurance With Teen Drivers In The ...

No matter how you cut it, insuring a teen will greatly increase your car insurance coverage expense. An analysis of California rates discovered that chauffeurs pay a typical $1,783 a year for complete coverage and $5,660 when a teen is added to the policy.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation