Welcome to

On Feet Nation

Members

-

smithmorgan Online

-

Robert Online

-

Alice Online

-

Yolanda Online

-

Lovina Lindy Online

-

Esther Online

Blog Posts

Cara Clear Cache Android di Semua Merk HP

Posted by Lovina Lindy on September 12, 2024 at 7:21pm 0 Comments 0 Likes

More https://www.dumados.com/2024/09/cara-clear-cache-android.html

Top Content

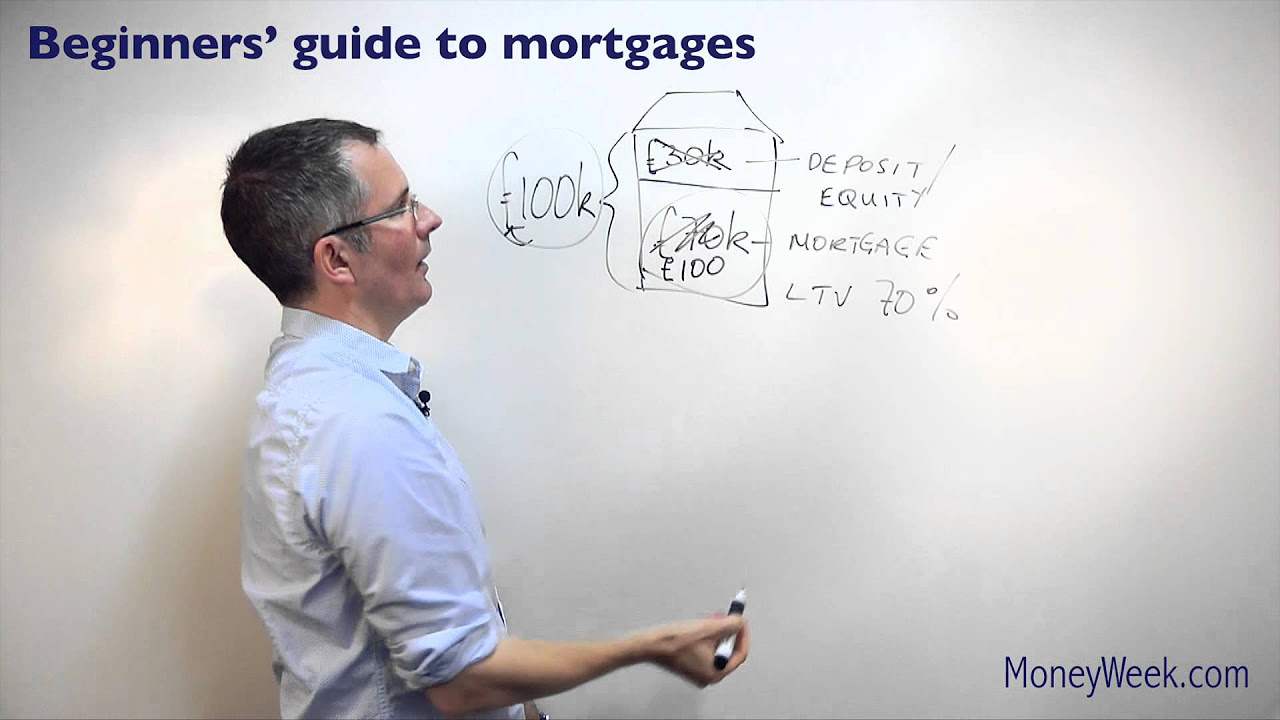

Responsible for a home loans Budget? 12 Top Notch Ways to Spend Your Money

Preparing to look for a mortgage can be demanding, particularly if you do not understand where to start. You can get a great start just from checking out these 5 excellent mortgage tips for first time house purchasers.

1. Pay down your financial obligation.

Specifically, your credit card debt. Why? Credit card financial obligation is expensive. The average rate of interest for credit cards currently is 13.8%-- that's double the 5.33% average for a 30-year set rate mortgage. Credit card debt likewise factors into how much you can obtain. Lenders will not permit your overall monthly debt ( that includes vehicle payments, trainee loans, homeowner's insurance coverage, and property taxes in addition to a mortgage and charge card) go beyond more than 40% of your gross earnings.

2. Know your credit rating.

Not ideal? Don't stress! Actually, purchasers can lastly catch a break. A few of the huge players in the lending market have actually lastly loosened their requirements, reducing the minimum FICO rating from 620 to 580 to get approved for a loan. Fannie Mae also uses an broadened approval program for those with slightly blemished credit. However, you website must constantly know precisely what is on your credit report before you begin shopping for a mortgage. That way you can clear up any inconsistencies or mistakes prior to lending institutions start making their questions.

3. Figure out what you can afford.

Regrettably, mustering up a deposit and after that writing a check each month is simply the beginning. You must likewise consider closing expenses, which can be as much as 3% to 5% of your house's overall value, in addition to property taxes and insurance. Funds for emergency home repairs are something else you ought to think about including. A basic rule of thumb is that your mortgage, insurance, and taxes should not surpass more than 28% of your gross income each year, which indicates that budgeting is crucial.

4. Do not settle right away.

Shopping around does take time and energy, but it can save you thousands in the long run.

Rates of interest and charges vary greatly, so declining the very first loan offered can actually be beneficial, even though it may appear like shooting yourself in the foot. Compare loans from both brokers and loan providers . Brokers organize loans with lenders. They function as a go-between, so if you do not want to deal directly with a lender, you might be interested in dealing with a broker.

5. Know your options.

Home mortgages can have several functions. Some have adjustable rates, others have actually repaired rates. There are home loans where you pay only the interest for a while and then pay down the principal, home loans that charge a penalty for paying the loan off early, and mortgages that have a balloon payment, or large quantity, due when the loan ends. Being well notified about all your options will guarantee you find the choice that's right for you.

The typical interest rate for credit cards presently is 13.8%-- that's double the 5.33% average for a 30-year set rate mortgage. Lenders will not enable your overall month-to-month debt (which includes cars and truck payments, trainee loans, house owner's insurance coverage, and residential or commercial property taxes in addition to a mortgage and credit cards) go beyond more than 40% of your gross earnings.

You ought to always be aware of precisely what is on your credit report prior to you begin shopping for a mortgage. A general rule of thumb is that your mortgage, insurance, and taxes should not go beyond more than 28% of your gross earnings yearly, which implies that budgeting is key.

There are home mortgages where you pay just the interest for a while and then pay down the principal, mortgages that charge a penalty for paying the loan off early, and mortgages that have a balloon payment, or big amount, due when the loan ends.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation