Welcome to

On Feet Nation

Members

Blog Posts

Top Content

Getting My What To Do If Your Car Is Totaled - Aaa To Work

Did you finance the last lorry? Due to the fact that this will likewise suggest that on top of the previously listed hurdles you might face, you'll be stuck to paying the rest of what you owe to your banks. The out-of-pocket expenses you might face even when you are not at fault can reach impressive numbers.

In her extra time, she delights in baking and hanging around with her family.

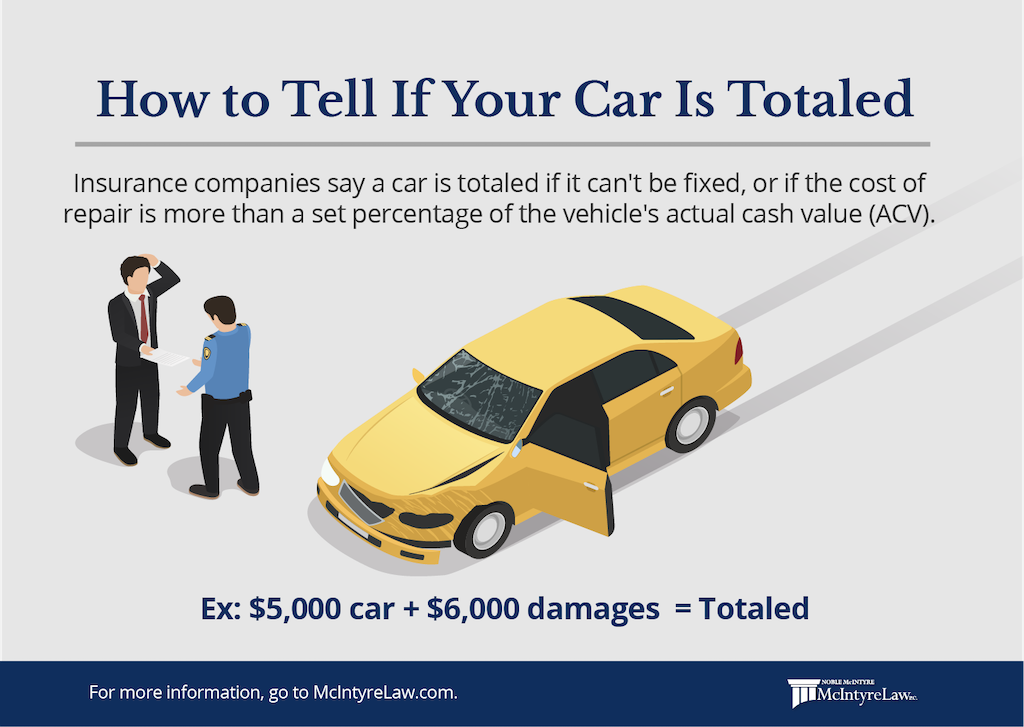

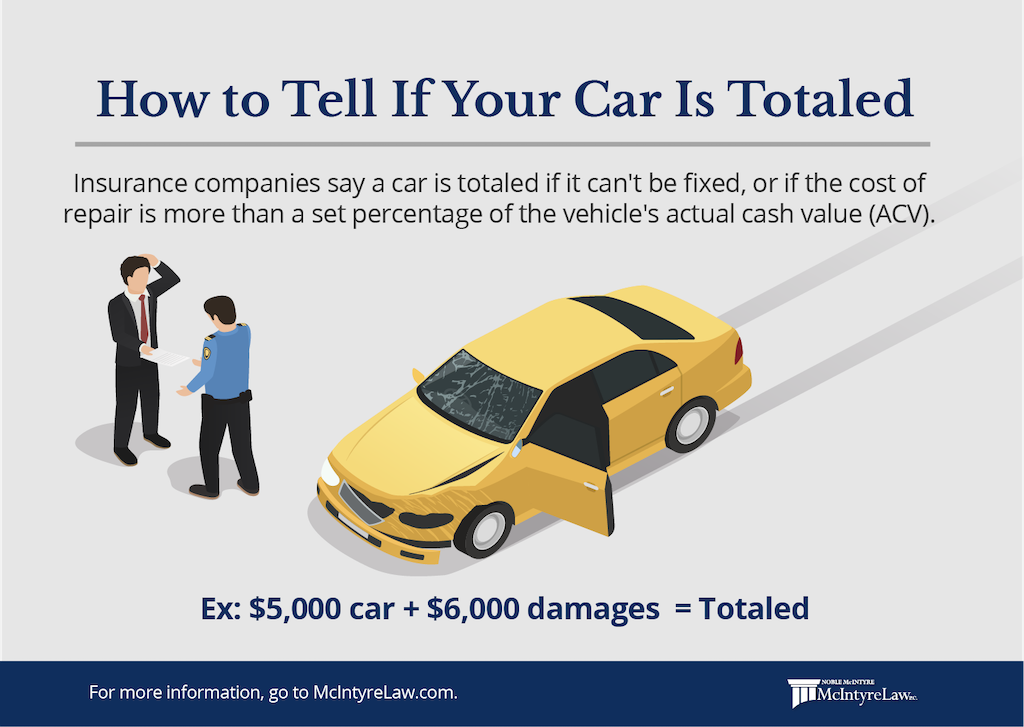

For additional information, please see our and An overall cars and truck loss is what takes place when the insurance coverage provider determines it costs more to fix the damage than to fix your lorry. It's not always because of a major mishap; your cars and truck may be amounted to since of a natural occasion.

However there are some actions you ought to anticipate when dealing with your insurance carrier, and understanding what to do in advance might reduce the procedure for you. The most important primary step if your car is involved in a mishap or event that causes significant damage to it is to call your insurer right away.

Totaled: Upside-down Car Loans And When Gap Insurance ... - Truths

What Occurs When Your Vehicle Is Amounted to? An overall car loss can occur in numerous situations.

The payment is based on the reasonable market price, or Actual Cash Worth (ACV). If you have accident and extensive protection choices on your automobile policy, then your overall loss is paid at ACV minus your deductible. ACV is merely a term for what was as soon as called the "book worth" of the car, Miller discusses or the value of your vehicle when accounting for the devaluation that all cars and trucks start sustaining as quickly as they leave the lot.

They will desire to understand if it's a loan, how much do you owe," Miller says. That's because you might owe on the automobile more than the carrier pays out, or you may not be existing with payments on your vehicle loan. "If you have not made payments, or are upside down or late, now there is a space [between] what you owe and what you're getting paid," Miller says.

Space insurance bridges the distinction between what you owe and the amount of the payout from the insurance coverage carrier. If you don't have this optional coverage in your policy, then you require to come up with the rest. If You Wish to Keep Your Car After It's Stated an Overall Loss, If your insurance coverage carrier determines your vehicle is a total loss, you may question if it's possible to keep your car.

The smart Trick of What Happens When Insurance Totals Your Car? That Nobody is Talking About

Does your state allow it? Some states have constraints on keeping a vehicle after it's amounted to. If you do intend to drive it, can it be fully fixed? Will your car pass an inspection once repaired? Do you have an insurance provider that will insure a salvaged automobile!.?.!? If there is any doubt whatsoever about any of the points above, it's sensible to move on.

File An Insurance Claim, The faster you file your claim, the much better. The damage to your vehicle could be higher than you recognize, and the insurance provider must be involved from the start of the claim. Have Your Vehicle Towed to an Approved Body Store"Your vehicle does not need to go back to the dealership," says Miller.

Once you do that, then the shop can begin on the estimate."Collect Your Documents, Among the most important actions is to keep in mind to collect your documents inside the car. "Do not forget to take everything out of the automobile," says Douglas Heller, an insurance coverage consultant and professional with the Consumer Federation of America.

"Customers must insist that they get all the costs of changing the amounted to cars and truck," Heller says."Of course the insurance provider might not see the value in your car the way you do, and the payout might not equal what it costs to purchase a brand-new cars and truck.

What Does What Is A Total Loss Car? - Insurance Tips & More - Valiente ... Mean?

If You Are Leasing a Cars And Truck While Waiting Numerous chauffeurs require a rental vehicle while waiting for a decision on a payout, and usage insurance coverage to cover the rental expenses. Be aware there is a limitation to rental automobile coverage. After issuing your payment files, insurer will typically keep spending for the leasing for a "day or 2," Miller states.

If you owe more on the vehicle than what you're used, then you are accountable for the shortage, unless you have gap insurance coverage.

A look at the vehicle damage claim process and your choices if you disagree with the insurance coverage business's evaluation of your automobile., and the insurance company states that the car is a total loss, what takes place next? Does it matter which insurance company you are dealing with-- yours or the other driver's?

The answer to this concern depends upon whether the mishap happened in a no fault state or a non-no fault state and what type of coverage is being utilized to spend for your automobile. No-fault vehicle insurance coverage methods that the insurer will pay for specific damages despite who was at fault (and despite whether anybody was at fault).

Unknown Facts About What Happens If Your Car Is Deemed A Write-off? - Co-operators

And in any traditional fault state, liability in automobile mishaps will always be based upon negligence. This implies that insurance companies will just pay for vehicle damage if somebody was at fault, unless you have insurance protection that will spend for car damage regardless of fault, such as crash protection, which we'll talk about next.

Collision coverage can be quite expensive, given that it pays for automobile damage despite who triggered the underlying mishap. You can make a claim versus your own insurance company's accident coverage if you enter into a mishap that is your fault. The bottom line is that, if your automobile accident happened in a non-no fault state, the other chauffeur's insurer will only pay for your car damage if the other chauffeur was negligent.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation