Welcome to

On Feet Nation

Members

-

evan powers Online

-

momokbauuu Online

-

Cassandra Online

-

Kathleen Online

-

Donna Online

-

smithmorgan Online

-

dnna mayugh Online

-

-

Blog Posts

Top Content

All About What If I Can't Pay My Car Insurance Deductible?

While the amount of your insurance deductible can increase or decrease your costs, insurance deductible as well as premium are 2 different points. The called guaranteed on the policy is responsible for paying the insurance deductible quantity.

cheap insurance car insurance insurance cheap car insurance

cheap insurance car insurance insurance cheap car insurance

This means that even if somebody else was driving your car as well as obtained right into a mishap, your insurer would certainly handle the claim and you would certainly be in charge of your policy insurance deductible. It's not the same as a medical insurance deductible. Deductibles for medical insurance policies commonly cover an entire 12 months, suggesting you would only compensate for your deductible (i.

Nevertheless, an automobile insurance policy deductible applies "per event." This implies you are accountable for your complete insurance deductible quantity each time you experience a protected loss. Similar to all things insurance coverage, it's best to go over deductibles and also exactly how they apply in your situation with a neighborhood independent insurance coverage representative. Your neighborhood independent agent has the expertise as well as experience to address frequently asked questions concerning deductibles as well as calculate expense savings for you depending on the deducible quantity you select.

cheap auto insurance cheaper cars business insurance auto insurance

cheap auto insurance cheaper cars business insurance auto insurance

When you acquire cars and truck insurance coverage, you'll need to make several options concerning your insurance firm as well as optional insurance coverages. You'll also need to choose your insurance policy deductible, which can be much more difficult than it seems. Should you try to save cash by choosing a higher insurance deductible or feel more protected by going with a lower one? To pick the ideal insurance deductible for you, you'll require to consider your driving history, your emergency situation fund, as well as the expenses of various deductibles, along with several various other elements. car.

What If I Can't Pay My Car Insurance Deductible? Can Be Fun For Everyone

Trick Takeaways Your deductible is the portion of expenses you'll spend for a covered case (trucks). Consider your car's value, your emergency situation fund, as well as the expenses of coverage when picking a deductible. Choosing a higher insurance deductible might help you conserve money on premiums, however this suggests you'll have to pay even more out of pocket after an accident.

In some states, you might additionally have a deductible for:: Pays to fix your car after damage triggered by a chauffeur without insurance or without adequate coverage.: Pays your medical costs when you have actually been harmed in an accident. cheap.: Covers the prices of some mechanical repair services, just like a guarantee.

Whether you pay an insurance deductible after an occasion depends on your insurance coverage, who is at fault, your insurance coverage business, and also your state's laws. For instance, in The golden state, you might get a deductible waiver on your accident coverage, which suggests your insurer will certainly pay the deductible if a without insurance motorist strikes you.

Just how Does a Deductible Work? Picture a tree branch falls on your automobile and also causes damages. You sue on your detailed protection as well as the fixing shop estimates it will set you back $1,000 to fix - car insured. What you'll pay depends upon your deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the price of fixing the damages is the same or nearly the like your deductible, you might pick not to submit a case considering that you would certainly shed any type of claim-free price cut.

Indicators on Should I Raise My Auto Insurance Deductible? - Coverage.com You Need To Know

car cheapest dui cheap insurance

car cheapest dui cheap insurance

When Do You Pay a Deductible? You'll typically pay your insurance deductible straight to the auto fixing shop after they finish the repairs. The insurance company will deduct your section from the overall they send out to the repair service store. For instance, in the circumstance above, with a $500 insurance deductible, the insurance provider would pay the automobile repair service shop $500, as well as you would certainly be expected to pay the various other $500.

As the vehicle's worth boils down, the opportunity of a failure goes upmeaning it might not be worth getting optional insurance coverages - automobile. For example, the Kansas Insurance policy Department advises carrying only responsibility insurance coverage on cars and trucks worth less than $3,000. Due to a existing lack of previously owned cars, Mc, New bride pointed out that you may also intend to think about just how important your car is as a way of transport.

Other Concerns to Ask When Choosing Deductibles While the 3 variables above are the most crucial when choosing an insurance deductible, you'll want to ask these concerns, too. Lots of protection deductibles begin at $250 or $500, yet some insurance providers supply a $0 insurance deductible choice for particular insurance coverages, and also others might require higher-risk vehicle drivers to bring greater deductibles.

Can You Use Various Other Insurance Coverage to Cover the Prices of Injuries? In some states, you might be able to make use of health and wellness coverage to pay the expenses of injuries as a result of automobile accidents instead of counting on vehicle insurance policy coverage, such as medical payments or PIP insurance policy. In this case, you could choose a higher deductible or a reduced restriction on those coverages, which would save you money.

What Happens If I Increase The Deductible On My Car ... Things To Know Before You Buy

credit score vehicle cheapest cheap insurance

credit score vehicle cheapest cheap insurance

If your car is currently at the repair service store, you could get a lending to pay the insurance deductible or ask the store to hold your car till you can locate some extra cash. What Is the Highest Possible Deductible for Cars And Truck Insurance Coverage? The highest possible deductible offered to you relies on your state and also your insurer, but Mc, Bride-to-be claimed an ordinary high deductible is around $1,000.

For specialty vehicles or collectibles, they can get to $5,000 to $10,000. What Is the Average Deductible for Auto Insurance Coverage? No national average throughout states and insurance companies has actually been released, however Progressive states $500 is one of the most typical insurance deductible picked by its insurance holders.

What is the difference in between a deductible and also a costs? A premium is the quantity of cash that you would pay your insurance provider in order to maintain your policy active. Unlike a deductible, your premium is usually paid on a monthly, annual, or semi-annual basis. Your deductible as well as your costs go hand-in-hand; if one is higher, than the other will be lower because Browse around this site of this.

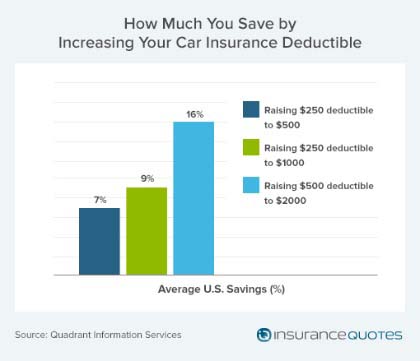

Will increasing my deductible really save me money? The short as well as easy response to this concern is indeed; if you enhance your insurance deductible, you will certainly conserve money on your costs. Nonetheless, this will really rely on your very own individual situation. Simply put, the greater insurance deductible you pick the lower the premium.

The Only Guide for Who Pays The Deductible In A Car Accident? - Anidjar & Levine

If your deductible is exceptionally high, You will certainly be in charge of paying it completely whenever an insurance claim takes place - cheapest car insurance. Having a high deductible can additionally negatively influence you in case of submitting a little insurance claim. If the cost of damages you are declaring are much less than the price of your deductible, it will certainly make no sense for you to also file the case.

If you live in a city that has a huge volume of tiny crashes as a result of heavy website traffic, after that a reduced deductible is probably your best option as you might be a lot more likely to obtain into a mishap than a person living in a reduced inhabited area.

This is so you will not need to pay out such a large amount each time that you make an insurance claim. However, if you have a spick-and-span driving record, having a greater deductible could be beneficial for you. Final thought: You have alternatives Choosing what cost to set your insurance deductible at can be a difficult decision.

Have more concerns regarding your deductible, superior or other coverage alternatives? Contact us with one of our certified insurance experts today - insurance.

Some Ideas on How Do Deductibles Work For Car Insurance? - Kelley Blue Book You Need To Know

What is an insurance deductible? A deductible is the quantity you pay of pocket towards fixings for your vehicle because of a covered loss. laws. If you have a $500 deductible as well as you're in an accident

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation