Welcome to

On Feet Nation

Members

-

smithmorgan Online

-

Amy Online

-

Robinjack Online

-

goditac499 Online

-

Cassandra Online

-

Genaro Online

-

BillShiphr Online

-

joseph7ipe Online

-

Blog Posts

Buy Best Reloading Supplies In stock 2024 ( Primers, Powders and Reloading Brass)

Posted by smithmorgan on November 11, 2024 at 8:37am 0 Comments 0 Likes

Buy Best Reloading Supplies In stock 2024 ( Primers, Powders and Reloading Brass)

Posted by smithmorgan on November 11, 2024 at 8:37am 0 Comments 0 Likes

Buy Best Reloading Supplies In stock 2024 ( Primers, Powders and Reloading Brass)

Posted by smithmorgan on November 11, 2024 at 8:36am 0 Comments 0 Likes

Buy Best Reloading Supplies In stock 2024 ( Primers, Powders and Reloading Brass)

Posted by smithmorgan on November 11, 2024 at 8:36am 0 Comments 0 Likes

Top Content

10 Reasons To Avoid Reverse Mortgage

Prior to making the final decision, you might want to speak with a monetary organizer or licensed home loan banker to dig deeper into your economic scenario as well as see if this is an excellent choice. Your property requires to be maintained as well as for some this is not possible with a physical disability. You could use the funds from the reverse home mortgage to hire aid but something that you ought to know. As soon as the financing is repaid, if there is still equity, the cash will be distributed to you or to your estate. A reverse mortgage turns residence equity into cash money-- without requiring that you vacate your residence. But before you enter, here's what you require to know about the possible downsides.

- After you pass, your successors will certainly receive much less of an inheritance.

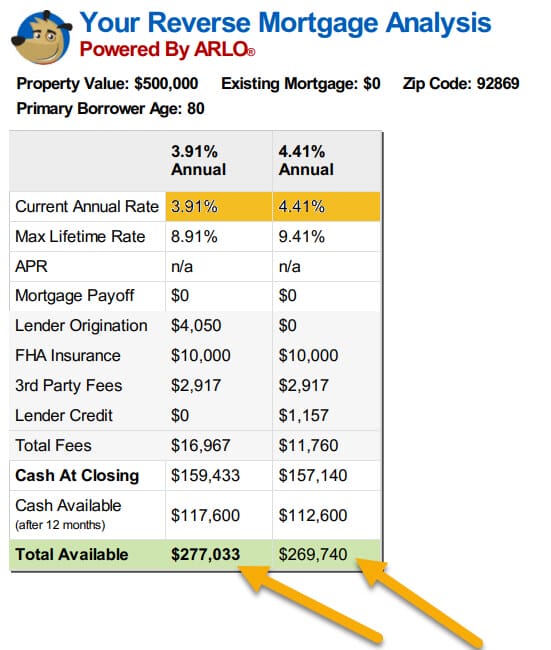

- The MoneySmart website has a valuable reverse mortgage calculator that shows how much of your house you'll possess after various finance durations based on factors such as age, home value, rates of interest as well as fees.

- Carriers market the benefit of utilizing a reverse home loan to raise savings by changing wealth from your house to your investments.

- If every person in your house is 62 years old, there's no worry the lending institution will call the funding due if you vacate or die.

- Your reverse home mortgage settlements might not cover all your costs, possibly leaving your property taxes or property owner's insurance coverage unsettled.

Postmedia is dedicated to keeping a lively yet civil forum for discussion and also encourage all readers to share their views on our write-ups. Remarks might occupy to a hr for moderation prior to showing up on the website. We ask you to maintain your remarks pertinent and also respectful. We have allowed email notices-- you will certainly now obtain an e-mail if you obtain a reply to your comment, there is an upgrade to a remark thread you adhere to or if a user you comply with remarks.

Exactly How Does Lendingtree Earn Money?

If it's worth greater than what it owed, you get to keep the distinction. Lenders may look at other elements that enter into play when you obtain a standard financing, like your credit history and debt-to-income proportion. Yet the DTI is not typically considered in the certification.

Drawbacks Of A Reverse Home Mortgage

That would certainly eat up a lot of the equity a borrower has in their home. And the origination cost is based on the residence's worth, which is generally much bigger than the finance timeshare only amount. Neither is your credit rating if you are obtaining a HECM funding, though if you have any arrearages like federal pupil loans you will certainly not be authorized.

Who Is Not An Excellent Candidate For A Reverse Mortgage?

If there is equity left in the home after that the successors will receive that equity after the sale of the house. There are lots of factors to avoid taking a reverse mortgage loan on your main house. Your equity is normally in America the largest source of wealth and you need to obtain educated to shield this wealth you have collected. After composing and evaluating the downsides of this lending, we should state that for most of senior citizens this is a feasible program for retirement success. If you have concerns or issues after reviewing this post please get in touch with us so we can describe in more details for your particular case. Every person has different retired life goals, wealth/financial buildups, and assumptions of just how Check over here they intend to retire.

You offer the house or transfer title (the house's ownership) to another person, and also no other consumer keeps title or a particular kind of leasehold in the building. You pass away, and the residential property is not the primary house of at least one making it through debtor. A nonborrowing partner may be able to remain in the residential or commercial property also after the customer has actually died if details standards are met.

A reverse home mortgage can be used to turn part of the equity in a residence right Visit the website into funds to combine credit card financial debt, lower monthly costs and even more. If you don't predict having any kind of cash flow problems currently or in the future, a reverse mortgage may not be required for you. [newline] As opposed to making a payment every month, you will pay nothing. The passion expense is contributed to the mortgage equilibrium, so in the second month, the balance grows. Considering that the funding balance is currently a little larger, the rate of interest expense is a touch higher, and this procedure proceeds till the time comes for the financing to be repaid. That repayment normally happens within one year of when you vacate the home or when you pass away. Single-purpose reverse home loan-- These are not as usual, and also the money you acquire from one of these can only be utilized for one specific need, such as restoring component of your home or paying your property taxes.

© 2024 Created by PH the vintage.

Powered by

![]()

You need to be a member of On Feet Nation to add comments!

Join On Feet Nation